Critical assessment of Alternative investment rule – 2015

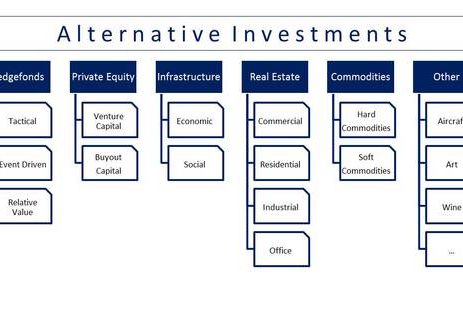

There are a number of grounds upon which this ‘Alternative Investment Rule -2015’ can be critically assessed. ‘Alternative investment’ – it is one of the four broader asset classes where portfolio investors can vest their fund. The alternative investment covers private equity investment, venture capital investment, impact fund investment, real estate, hedge fund investment, gold, minerals, forestry and so many other investments with some common characteristics – low liquidity, ambiguous valuation and higher return. Quite surprisingly, alternative investment rule [...]