Why are Bangladesh based entrepreneurs not coming to equity market?

Entrepreneurs, established entrepreneurs do have funding needs; they will need external funding for financing acquisitions, expansions or extracting value from real options. Equity market is a popular financial intermediation medium available to entrepreneurs.

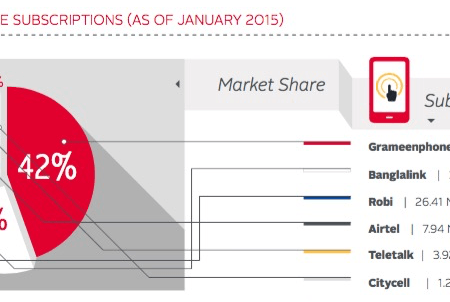

The biggest and most successful entrepreneurs in the country are yet to find the capital market a lucrative source of financing for their companies that they built over the years. Take, for instance, the case of Meghna Group of Industries, which is one of the biggest conglomerates in Bangladesh, with an annual turnover of $2 billion and asset base of $1 billion. The group has affiliation in more than 30 industries with 15,000 employees, 3,000 distributors and 1,000 suppliers across the country. But none of the companies of the group is listed on the stock exchange. PRAN-RFL Group, which is one of the largest and fastest growing conglomerates in the country, has around 50 units but only one – Agricultural Marketing Company, which is commonly known as AMCL Pran is listed in the stock exchange. The other big and well-known business conglomerates like Abul Khair Group, Bashundhara Group, City Group, Partex and PHP Family are not listed on the stock market. However, business groups like Square, Beximco, ACI, Summit, Orion, Unique, BSRM and S Alam have one or more listed entities in the market. Well renowned MNCs like Nestle, Unilever etc. have no stock listing.

Why do the biggest and most successful entrepreneurs in Bangladesh are yet to find the capital market a lucrative source of financing? This phenomenon can either be explained from academic perspective or through analyzing the existing eco-system.

Even though, many people would not agree, but equity issuance is far costlier than debt issuance. It is not just the floatation cost (underwriting fee, investment banker’s commission, delays in the IPO or seasoned offering process) which I am referring to, cost of equity is considerably higher than cost of debt or cost associated with other financing modes. Yes, equity issuance does not necessarily entail the possibility of financial distress, but it means your equity would be diluted, your business secret would be exposed, your books of accounts would be regularly scrutinized and so on. Equity refers to residual claim and cost of equity is higher because the payment from holding equity security is uncertain.

Firms have a pecking order with their capital structure decisions. At first they will like to rely on internal funding; so successful and profitable firms would like to depend on their internally generated funds. Since the extent of overvaluation and the subsequent losses due to security overvaluation is significantly low with debt securities, CFO’s second preference should be debt securities like bond, debentures or preferred stock. Equity issuance is the least preferred financial intermediation tool as per the pecking order.

When a firm becomes a public one through listing it needs to adhere to strong transparency rules and governance rules. Disclosure volume (mandatory disclosure requirements) and disclosure frequency (four times a year) are increasing in our country. Political costs of disclosure are prevalent (Banking and telecom industry are exposed to a higher corporate tax rate). CEO’s strategic choices may become myopic; litigation cost of disclosures is also endorsed in the law. So, becoming a public company means regular scrutiny and adherence to a number of regulations. Corporate Governance Guideline (for listed Bangladeshi firms) stems from the recommendations of Cadbury Commission (1992), Sarbanes-Oxley act (2002) and OCED (2004). A listed Bangladeshi firm should have a different CEO and chairman of the board; its tax advisor and auditor should not be the same company; its board must be encompassed of independent non-executive directors; it should have a distinct risk management, internal audit, compensation committee.

Equity dilution is another big reason behind such indifference to the stock market. Even though through strategic offloading of shares much of the dilemmas of equity dilution can be managed; still the biggest and most successful entrepreneurs in Bangladesh do not like the idea of sharing voting rights and board representation with outside investors. Issuance of Class A (superior voting rights) and Class B (superior voting rights) shares can easily resolve the equity dilution problem as well.

Bangladesh’s corporate finance structure is not market driven rather it is dependent on bank-based solutions. Bangladesh based entrepreneurs depend on bank-based financial solutions to meet their long-term and short-term funding requirements. It is not a replication of the Japan-German Model whereby bankers sit in the borrowing company’s board and carefully monitor the strategic choices, but entrepreneurs in this part of the world prefer bank-based financial solutions because of the relative ease and cheaper interest rate. Interest rate has fallen over the years and the opportunity to take foreign loans has widened up. The cost of taking loans from banks is now far cheaper than raising funds from the capital market.

Listed companies enjoy tax benefits in Bangladesh. Corporate tax rate for publicly listed companies is 25%, whereas 35% is the tax rate applicable for non-publicly traded firms. If any non-publicly traded company transfers minimum of 20% shares of its paid-up capital through IPO it would get 10% rebate on total tax in the year transfer. Issue management fee (1% and 2% of the offer amount in case of fixed price method and book building method respectively) and underwriting fee (maximum 1% of the underwritten portion) are also reasonable under the international standards. Still IPO is not the most popular financing mode to the entrepreneurs; entrepreneurs prefer the formal banking channel to finance their BMRE projects. Across time, IPO’s contribution in the formal financing channel is less than 1%. The 10-percentage point tax incentive is not enough to attract the big and successful companies and the tax gap between the listed and non-listed firms should be at least 15 percentage points. The companies should also be given VAT incentives if they get listed on the bourse.

Along with these policy prescriptions, a big push should also come from the government as offloading government’s stake in state-owned companies can increase the depth and breadth of the equity market. Privatization and deregulations is the buzzword. In UK, Thatcher started privatization and privatization is now rampant in transport, telecom, National Health Service. India started privatization through throwing away the License Raj concept. USA limited the applicability of Glass-Steagall act and financial intermediation business were liberalized. There are different arguments given in favor of a less-happening government like increasing public’s stake in the public property, reducing nasty concentration by the oligarchs and mostly better management. Government’s privatization initiative can entice Bangladesh based entrepreneurs to issue equity and quasa-equity securities in our stock market.

Leave a Reply