Evolution of E-payment industry: Bangladesh Experience

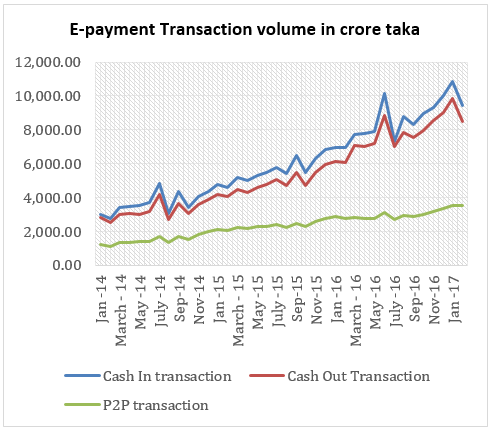

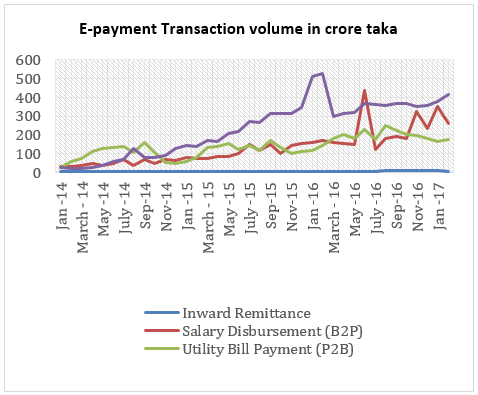

Major MFS (Mobile financial Service) transactions encompass – Cash in transaction, Cash out transaction, P2P Transaction, Salary disbursement (B2P), Utility Bill Payment (P2B), Inward remittance and Others. MFS providers earn most of their revenue by performing three transactions – Cash in, Cash out and P2P. In 2014, these three Mobile financial services churned 98% of the industry e-payments; whereas in 2017 the contribution was around 96%. Cash-in transaction is the biggest mode of e-payment transactions, followed by cash-out transaction. P2P transaction’s share in industry e-payments has marginally dripped from 2014 to 2017. Overall e-payment transactions in the industry have grown multifold, but industry’s major value drivers have remained the same.

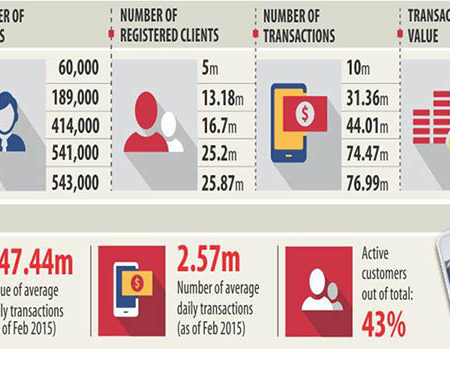

From 2014 to 2016, the number of MFS agents, active MFS accounts and daily transaction volume has almost tripled showing increasing access to payments services and thereby MFS is significantly expanding financial access. Major MFS activities like – Cash in, Cash out and P2P have experienced immense growth; on an average the transaction volume of Cash in, Cash out and P2P has increased at CAGR 3% (approximately) on a monthly basis. Even though, B2P and P2B are not the major sources of industry revenue, these two transactions have become even more popular during this timeframe. On an average B2P and P2B have registered a 5.6% (approximately) growth on a monthly basis.

From 2014 to 2016, the number of MFS agents, active MFS accounts and daily transaction volume has almost tripled showing increasing access to payments services and thereby MFS is significantly expanding financial access. Major MFS activities like – Cash in, Cash out and P2P have experienced immense growth; on an average the transaction volume of Cash in, Cash out and P2P has increased at CAGR 3% (approximately) on a monthly basis. Even though, B2P and P2B are not the major sources of industry revenue, these two transactions have become even more popular during this timeframe. On an average B2P and P2B have registered a 5.6% (approximately) growth on a monthly basis.

Major MFS (Mobile financial Service) transactions encompass – Cash in transaction, Cash out transaction, P2P Transaction, Salary disbursement (B2P), Utility Bill Payment (P2B), Inward remittance and Others. MFS providers earn bulk of their revenue by performing three transactions – Cash in, Cash out and P2P. In 2014, these three Mobile financial services churned 98% of the industry e-payments; whereas in 2017 the contribution was around 96%. Cash-in transaction is the biggest mode of e-payment transactions, followed by cash-out transaction. P2P transaction’s share in industry e-payments has marginally dripped from 2014 to 2017. Overall e-payment transactions in the industry have grown multifold, but industry’s major value drivers have remained the same.

Blog Writer: Hussain Ahmed Enamul Huda

Leave a Reply