Regulation in MFS industry is a must, but how much?

MNOs (mobile network operators) are better endowed to provide MFS (mobile financial service) than the case with majority of financial institutions. Strong technological infrastructure and widespread distribution network is integral to develop MFS eco-system. MNO’s distribution network is widespread at the root level, even at the remotest locality. Increased competition has forced private bankers to eventually opt out for retail banking; but a banker’s branch network is straightway no match with an MNO’s distribution network. MNOs also own the key communication infrastructure required to provide mobile payment services. Unstructured supplementary service data (USSD), a communications service controlled by MNOs, is the critical piece of infrastructure used to provide MFS on nearly any phone, at low cost and without requiring access to the user’s SIM card. So, in terms of technological infrastructure and the reach of distribution network, MNOs enjoy strategic advantage over FI (financial institutions).

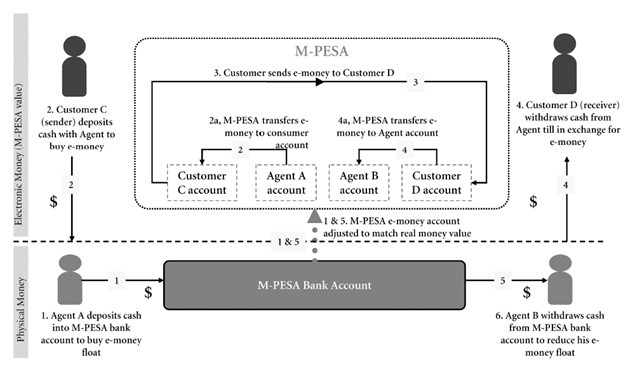

Despite the above-mentioned competitive edges, all MFS business module are not necessarily MNO-led. Regulators across the world have questioned MNO’s lack of exposure in dealing with people’s money, safeguarding people’s money. So, the preference for a bank-led MFS model over an MNO-led MFS model is a regulation-driven decision not always a rational business decision. But the risk of MFS account holder losing their e-wallet money can be mitigated if 100% of the cash backing the e-money is held in a prudentially regulated institution (bank or MFI). who have opted out for a MNO-led MFS module have also made sure that MNO does not intermediate the fund.

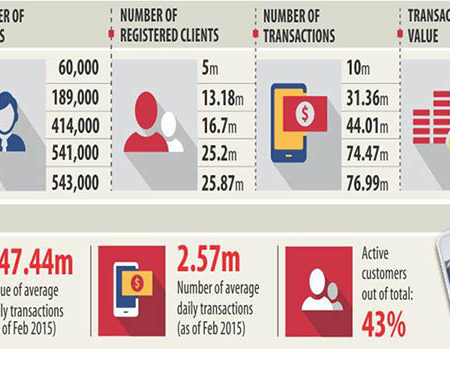

At some part of world, regulators are very conducive towards ensuring an enabling regulatory framework for MFS providers. For Example, in Kenya, regulators have even allowed M-PESA (an MNO-led MFS model) to introduce formal banking (M-Kesho), micro-finance (musoni) and insurance products. In India, RBI has endorsed Airtel (an MNO) to leverage on its technological infrastructure and the reach of distribution network by introducing payment bank. Airtel’s payment bank account holders will enjoy all traditional MFS services like cash-in, cash-out, P2P, P2B, B2P; most importantly they will earn hefty interest on their e-wallet savings. These ‘narrow banking’ institution (MNO subsidiaries) can offer savings, payments, and cash-in/out services, but can not issue credit and would be required to store 100% of their deposits in RBI (which would then invest in government securities). Regulators of Bangladesh (Bangladesh Bank and Bangladesh Telecommunication Regulatory Commission) have not quite liberalized the MFS industry and MNOs only act as a telecommunication partner in the MFS value chain under a revenue sharing agreement. Grameenphone (country’s biggest MNO) has launched its mobile wallet solution (basically a mobile app named GPAY) for its mobile account holders. GPAY allows Grameenphone customers to convert their airtime into electronic money (cash-in) and perform P2B transactions. Since, GPAY does not allow key MFS facilities like cash-out and P2P services, it can at best termed as a limited-scale and highly regulated MFS solution provider.

Under an ‘enabling regulatory approach’ for MFS industry, it is expected that MNOs will be licensed directly (Kenya model) or be licensed to operate as a payment bank (India model) or be allowed to set-up a subsidiary. Regulators can always ask myriad questions, questions regarding the status of an e-wallet (should it be treated as a deposit or not), regarding the right to get interest on e-wallet saving, regarding MNO’s stance towards launching credit products, regarding the implementation of interoperability models without allowing for a market-led approach. But regulators should also respect people’s right to get basic amenities like payment service at an affordable price. It is only the co-existence of bank-led and MNO-led MFS model that ensures an enabling environment in the MFS industry even under the ever-cautious regulatory umbrella.

Leave a Reply