Agent Banking: Prospect & Challenges

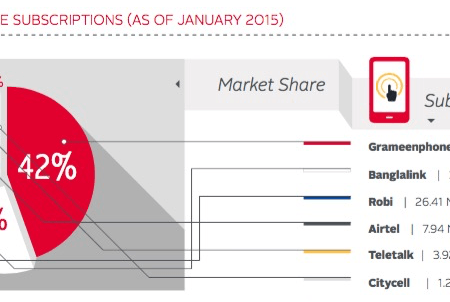

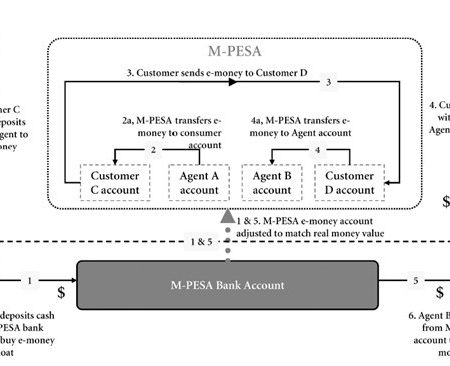

Agent banking should play an instrumental role in including the unbanked under the formal banking umbrella of Bangladesh. MFS (mobile financial services) are mostly payment services, but agent banking is basically a limited-purpose banking solution. Access to payment service is often termed as an elementary-level human right; MNOs (Mobile Network Operators) have the competitive edge (technological set-ups like USSD and vast reach) to run payment-services successfully. So, payment service needs to be an MNO-territory. Even though, under the existing payment-service industry’s competitive space, bank-led, MNO-led, payment company-led MFS solutions do co-exist, basically it should be an MNO-led model. But is ‘Access to payment service’ ensures ‘Access to banking solutions’? Or should we allow MNO-led limited-scale banking solutions for Bangladesh economy?

Even though, both MFS and agent banking foster financial inclusion; their modus of operation are quite different. MFS platform only allows varieties of payment services like cash-in, cash-out, P2P, P2G, P2B, B2G, P2G, G2P etc. On the other hand, agent banking is a limited-purpose retail banking solution and it covers banking facilities like deposit taking, loan documentation and other paper work facilities.

Unlike the MFS mechanisms, agent banking can easily be regulated and operated within the traditional banking eco-system. The regulators are seriously concerned about the OTC transactions of the major MFS providers. Researchers often cite the relatively higher margins charged by the MNOs (Mobile Network Operators) in the MFS value chain. A private commercial bank has to absorb enormous fixed cost to establish its branch at remote locations. So, a geographically diverse branch banking will not necessarily be everybody’s cup of tea.

But does ‘Agents’ or ‘Sub-agents’ necessarily replace bank branches someday? As per the existing legal framework, it is quite not possible and even from ‘adverse selection’ and ‘moral hazard’ concerns these practices under ‘agent banking’ framework should be prohibited. So, in the coming decades we can expect more and more agents and sub-agents offering limited-purpose banking solutions to the unbanked ones.

Date: 13 July, 2017

Blog Writer: Hussain Ahmed Enamul Huda

Leave a Reply