MNO-led MFS Framework: Telenor’s Global Experience

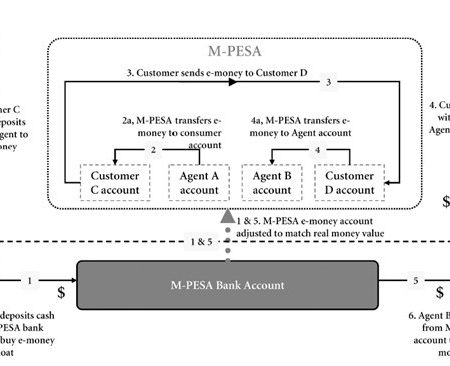

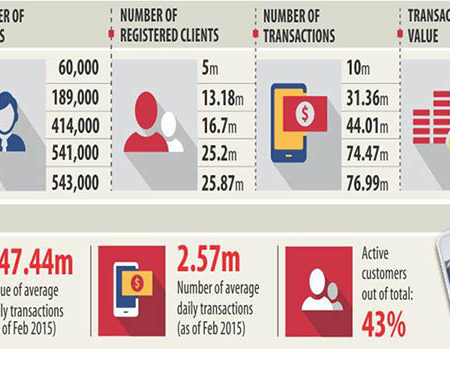

At some part of world, regulations are very conducive towards ensuring an enabling regulatory framework for MFS providers. For Example, in Kenya, regulators have even allowed M-PESA (a MNO-led MFS model) to introduce formal banking (M-Kesho), micro-finance (musoni) and insurance products. In India, RBI has recently endorsed Airtel (an MNO) to leverage on its technological infrastructure; Airtel’s payment bank account holders will enjoy all traditional MFS services like cash-in, cash-out, P2P, P2B, B2P; most importantly they will earn hefty interest (currently 7.25%) on their e-wallet savings. These ‘narrow banking’ institutions (MNO subsidiaries) can offer savings, payments, and cash-in/out services, but cannot issue credit and would be required to store 100% of their deposits in RBI (which would then invest in government securities).

Regulators of Bangladesh (Bangladesh Bank) have not quite liberalized the MFS industry and MNOs only act as a telecommunication partner in the MFS value chain under a revenue sharing agreement. Telenor is one of the world’s biggest MNO operating in Scandinavia, Europe and Asia. Grameenphone (Bangladesh’s biggest MNO) is a subsidiary of Telenor Group (56% ownership). It has launched its mobile wallet solution (basically a mobile app named GPAY) for its mobile account holders. GPAY allows Grameenphone customers to convert their airtime into electronic money (cash-in) and perform P2B transactions.

| Particulars | Bangladesh | Pakistan | Myanmar | Thailand | Malaysia | Serbia | Hungry |

| MFS Brand name | GPAY | Telenor Microfinance Bank | Wave Money | Paysbuy, Jaew Wallet | Valyou | Telenor Banka | Mywallet |

| Enabling regulatory framework | ✖ | ✓ | ✓ | ✓ | ✓ | ✓ | ✖ |

| Cash-in | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Airtime recharge | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Cash-out | ✖ | ✓ | ✓ | ✓ | ✓ | ✓ | ✖ |

| P2P | ✖ | ✓ | ✓ | ✓ | ✓ | ✓ | ✖ |

| P2B | ✔ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Deposit mobilization | ✖ | ✓ | ✖ | ✖ | ✖ | ✓ | ✖ |

| Credit facilities | ✖ | ✓ | ✖ | ✖ | ✖ | ✓ | ✖ |

| Micro-Insurance | ✖ | ✓ | ✖ | ✖ | ✖ | ✖ | ✖ |

Table: Telenor’s MFS experience across countries

Since, GPAY does not allow key MFS facilities like cash-out and P2P services, it can at best termed as a limited-scale and highly regulated payment solution provider. So, Telenor’s experience is far rosy in other parts of world since regulatory environments are becoming far ‘enabling’ there.

Blog Writer: Hussain Ahmed Enamul Huda

Leave a Reply