Rocket: A test case for financial inclusion

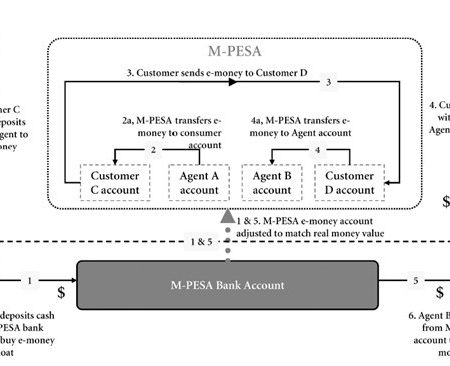

Access to quality payment service is a basic human right and now considered as a nascent step towards financial inclusion. Broadening up the financial inclusion base is certainly becoming a macro-economic priority across the globe, but it needs huge investment in MFS platform and value chain. Like any other key stakeholders of the financial system, commercial banks also cherish financial inclusion, but does that necessarily mean banks should invest huge fortune just out of corporate philanthropy or social CSR? The Peruvian and Ecuadorian approach to mobile financial service will certainly disagree to a private banker’s role in broadening up the national financial inclusion base. The Ecuadorian approach to mobile financial services is a policy approach rather than a commercial approach; the Central Bank of Ecuador (CBE) established itself as the sole e-money issuer in the country. In Peru, based on an initiative of the Association of Banks (ASBANC), a group of more than 30 e-money issuers launched an open and interoperable e-money platform. A LDC or a developing economy must ensure access to quality payment service for its unbanked and under-banked masses. But the intricate question lies somewhere else: Who should ensure that key access? Is it necessarily a private banker’s job? If it is so, then should it be termed as a ‘CSR initiative’? Can financial inclusion initiates ever perceived as a source of revenue?

Dutch Bangla Bank Limited (DBBL) launched its MFS platform (named Rocket) in 2011. Even though, most of the private bankers are opting out for multi-bank MFS consortium led by a payment service company, DBBL preferred the mono-bank based MFS platform. Around 30% of MFS transactions are now conducted through Rocket platform. Unlike bKash (the market leader in Bangladesh MFS industry), Rocket uploads a different vision to MFS. KYC documentation, cash-in and cash-out transactions are directly supervised by Rocket’s business development center. For opening a MFS account under Rocket’s platform, a potential client must go through real time NID verification and AML/CFT compliances are much robust under Rocket’s infrastructure. Cash-in and cash-out transactions of agents and super-agents are continuously monitored to reduce the scale of OTC transactions. So, Rocket ensures a structured and supervisory environment for its eco-system.

Earlier, DBBL played the pivotal role in building-up the largest ATM network (92% of card-based transactions are ATM-led in Bangladesh) across the country. DBBL does not charge its customers for using ATM cards; whereas per ATM transaction incurs an approximate cost of $.5. Despite DBBL’s huge investment in MFS platform and value chain, Rocket is surprisingly cheap (for example, performing a P2P transaction under this MFS platform is free, whereas Rocket’s counterpart is charging 5-taka for the same transaction). So, why DBBL does not charge customers of its ATM services and majority of MFS transactions? Is it mere corporate philanthropy or business gesture?

The answer is subtle. Rocket is DBBL’s key strategic investment for building up a client base, which is not currently bankable. This unbankable mass has every potentiality to become bankable in the coming days. So, through cross selling (future deposit mobilization, credit mobilization opportunities) DBBL expects to leverage on this investment. It wants to lower its churn rate by making its switching cost very high. Moreover, DBBL does not pay interest on the wallet money (it is not mandatory to give away interest on wallet savings). Customer’s transaction frequency is far high in Rocket Platform in comparison to its counterpart (bKash). Rocket has not yet reached its break-even level; DBBL loses around $.75 million each month for running Rocket. But its market penetration level is surprisingly well; every month it is becoming more scalable.

So, how should a Bangladesh based private bank run its MFS business? And we have a very good example of what a private bank should do. Follow the Rocket model; focus on scalability, structure and supervision. Believe in the economic potentiality of the unbankable masses. At Rocket, broadening up the financial inclusion base is not a gift or donation to the society. It is core, hard-core prudential banking.

Leave a Reply