Key Risks under Venture Capital Framework

There are a number of sources from where risks under the venture capital framework can stem from; some of these risks are systematic like macro-economic risk and regulatory risk. But majority of the risks stem from bad management

Under the existing Alternative investment rule – 2015, it has been postulated that the eligible investors will not be able to liquid his or her position before the fund’s tenure. So it is very clear that investment in the venture capital fund is extremely risky in terms of reduced liquidity. Moreover, realization in the portfolio companies is also uncertain; one cannot merely forecast the exit time and the exit environment.

Agency problem under venture capital framework can incur in numerous relationships, between the fund manager and eligible investor, between angel investors and entrepreneurs, between venture capital firm and the investee company. But most of these conflicts can be recognized at an earlier level and through making air-tight indentures most of these potential conflicts can be mitigated.

Most of the portfolio companies funded under the venture capital firm’s equity financing packages are high-tech firms. Exposure to too many high-tech companies may eventually lead to higher concentration risk. Concentration risk of the venture capital firm can be managed through portfolio diversification.

When the equity funding is allocated to the entrepreneur or the investee company there is a corporate vision and the entrepreneur should try to stick to that corporate vision. But most often due to the lower control over the portfolio company lemon crisis emerges. The portfolio company often derails from the basic business vision and gets indulged in some other engagement that is considered to be extremely risky to get recovered. In order to reduce these risks, the board of the portfolio company should be represented by the fund manager’s designated people.

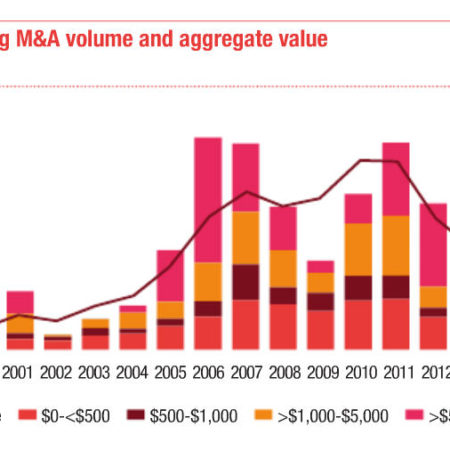

IPO, trade sale, recapitalization, and liquidations are the four generic ways that are often been used by fund managers across the board to take the exit from the portfolio companies. The exit price is an uncertain variable and the exit environment does play a huge role while determining the exit price. Generally, IPO fetches the best possible price but not very often all the portfolio companies’ share can be offloaded by selling IPOs. On the other hand, trade sale and liquidation can turn out to be disasters as there may not be any reference point that can be referred to at the time of the bargaining. So, price risk – to be more specific exit price risk is one of the biggest risks under the venture capital framework.

In order to understand the performance of the fund manager, it is important to value the investments locked in the portfolio company. There is no price quotations given for the portfolio companies and that makes the calculation of fair or intrinsic value even more difficult. Traditional valuation models like DDM (dividend discount model) or FCF (free cash flow model) will not be used in case of valuing these portfolio companies. Maybe relative valuation or taking the exit multiple of a sold-out company will become a better approximation of firm’s value.

Portfolio companies may fail to do the desired level of business due to the macro-economic condition of the country. Macro-economic variables or the systematic graph of the economy may not be very favorable during the tenure of the fund.

Date: 19 September 2017

Blog Writer: Hussain Ahmed Enamul Huda

Leave a Reply